Decent work and economic growth

Anisa, who turned to the profession of electronic device repairs to help women customers, mends a laptop at her phone and computer maintenance shop in Yemen.

© ILO/Ahmad Al-Basha/Gabreezfinancial system to tackle rising debts, economic uncertainty and trade tensions, while promoting equitable pay and decent work for young people.

Global economic recovery continues on a slow trajectory

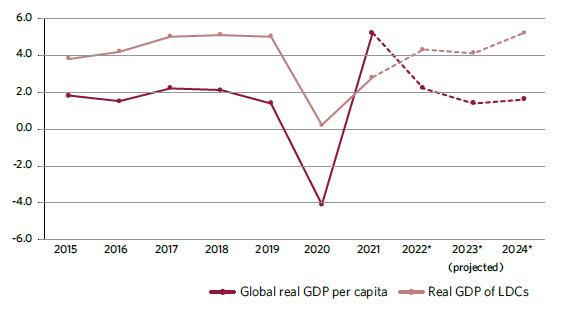

The global economy is grappling with persistent inflation, increasing interest rates and heightened uncertainties. Global real GDP per capita increased at an average annual rate of 1.8 per cent from 2015 to 2019, then sharply declined by 4.1 per cent in 2020 due to the COVID-19 pandemic. It then rebounded in 2021 with a solid 5.2 per cent increase, only to decelerate to 2.2 per cent in 2022. Estimates are that growth will further dwindle, to 1.4 per cent in 2023, followed by a modest increase of 1.6 per cent in 2024.

In LDCs, the annual growth rate of real GDP dropped from 5 per cent in 2019 to just 0.2 per cent in 2020 before recovering to 2.8 per cent in 2021. However, it is estimated that growth will resume, with the annual rate rising to 4.3 per cent in 2022 and further increasing by 4.1 per cent and 5.2 per cent in 2023 and 2024, respectively. However, these growth rates still fall short of the SDG target of 7 per cent.

Annual growth rate of global real GDP per capita and annual growth rate of real GDP of LDCs, 2015–2024 (percentage)

Challenging economic conditions are pushing more workers into informal employment

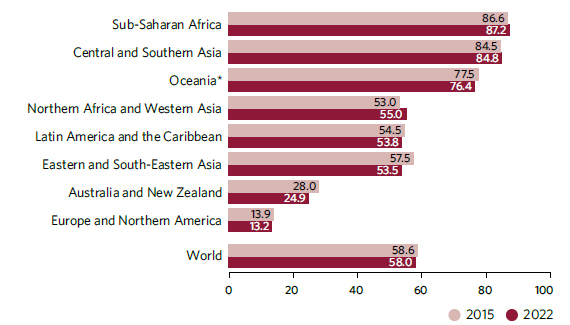

Before the pandemic, the incidence of informal employment had been slowly declining, from 58.6 per cent in 2015 to 57.8 per cent in 2019. However, COVID-19 lockdowns and containment measures resulted in disproportionate job losses for informal workers, particularly women. The subsequent recovery was driven by informal employment, which saw a slight uptick, reaching 58.0 per cent in 2022. This corresponds to around 2 billion workers in precarious jobs without social protection.

The situation was most alarming in LDCs, where informal employment stood at 89.7 per cent in 2022, with no improvement since 2015. Sub-Saharan Africa and Central and Southern Asia also continued to have high informality rates, at 87.2 per cent and 84.8 per cent, respectively. Women have been worse off during the employment recovery, with four out of five jobs created in 2022 for women being informal, compared to only two out of three jobs for men.

Proportion of informal employment, 2015 and 2022 (percentage)

*Excluding Australia and New Zealand.

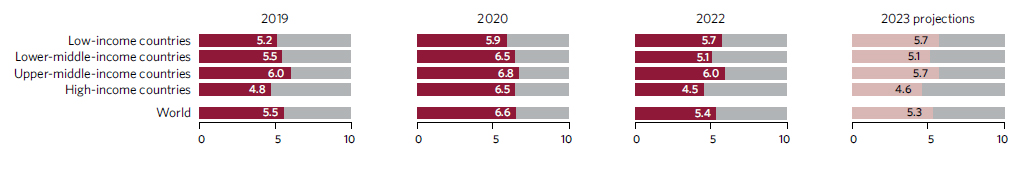

Global unemployment is expected to decline below pre-pandemic levels, but challenges persist in low-income countries

The global unemployment rate declined significantly in 2022, falling to 5.4 per cent from a peak of 6.6 per cent in 2020 as economies began recovering from the shock of the COVID-19 pandemic. This rate was lower than the pre-pandemic level of 5.5 per cent in 2019. The estimated total global unemployment in 2022 was 192 million. Projections indicate that global unemployment is expected to decrease further to 5.3 per cent in 2023, equivalent to 191 million people. This decline reflects greater-than-anticipated labour market resilience in high-income countries in the face of the economic slowdown. However, low-income countries are unlikely to see such declines in unemployment in 2023.

The pandemic disproportionately affected women and youth in labour markets. Women experienced a stronger recovery in employment and labour force participation than men. However, young people aged 15–24 continue to face severe difficulties in securing decent employment, and the global youth unemployment rate is much higher than the rate for adults aged 25 and above.

Unemployment rate, 2019, 2020, 2022, and 2023 projections (percentage)

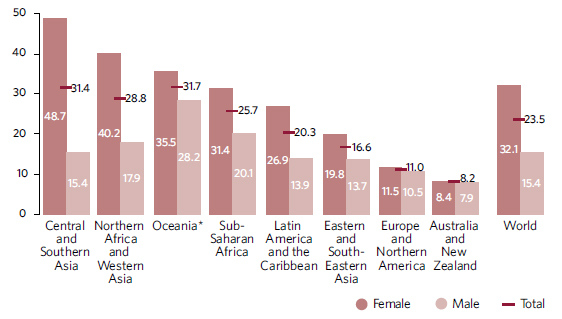

Young women are more than twice as likely as young men to be out of education, employment or training

Globally, nearly 1 in 4 young people (23.5 per cent or 289 million) were not in education, employment or training (NEET) in 2022. While this is a slight decrease from the peak in 2020, it remains higher than pre-pandemic levels and also above the 2015 baseline of 22.2 per cent. Across regions, the situation remains most dire for young people in Central and Southern Asia and in Northern Africa and Western Asia, with NEET rates of 31.4 and 28.8 per cent, respectively. Meanwhile, sub-Saharan Africa recorded the highest rate increase from 2015 to 2022, with now more than a quarter of young people in the region not in education, employment or training.

Alarmingly, young women remained more than twice as likely (32.1 per cent) as young men (15.4 per cent) to not be in education, employment or training in 2022. Efforts to reduce youth NEET rates, especially among young women, need to be intensified to address the long-term impacts on their economic potential and future opportunities.

Share of youth not in education, employment or training by sex, 2022 (percentage)

*Excluding Australia and New Zealand.

Tourism is on a path to recovery, but still well below pre-pandemic levels

Tourism has been severely impacted by the COVID-19 pandemic. In 2020, the share of tourism in global GDP was nearly halved by the pandemic. There was a modest 6 per cent improvement in 2021, with the sector’s contribution to global GDP reaching 2.5 per cent. While this indicates that tourism is on a path to recovery, it is still considerably below the pre-pandemic level of 4.2 per cent in 2019. The recovery and economic contributions of the tourism industry varied across regions, largely influenced by remaining travel restrictions and the strength of domestic tourism. In 2021, tourism had higher economic contributions in Latin America and the Caribbean (5.9 per cent), Northern Africa and Western Asia (5.2 per cent) and Europe and Northern America (2.2 per cent) compared to sub-Saharan Africa (1.2 percent) and Central and Southern Asia (0.4 per cent).

COVID-19 has accelerated the adoption of digital solutions, transforming access to finance

The accelerated adoption of digital solutions, fuelled in part by the COVID-19 pandemic, is transforming access to finance. In 2021, 76 per cent of adults worldwide had an account at a bank or regulated institution such as a credit union, microfinance institution, or mobile money service-provider, a notable increase from 62 per cent in 2014. Technology has played a crucial role in advancing financial inclusion, as evidenced by the sizeable increase in mobile money accounts, from 4 per cent in 2017 to 10 per cent in 2021. New opportunities to reach the unbanked include leveraging digital payments, such as direct transfers of social welfare or wage payments, along with interoperable payments networks and telecommunications infrastructure. During the COVID-19 crisis, 39 per cent of adults in low- and middle-income economies opened their first account at a financial institution specifically to receive wage payments or government transfers.